Introduction: What is Jeonse and Why Should You Care?

If you’re moving to Korea, you’ll quickly realize that the rental system is very different from what you’re used to in the U.S. Instead of paying monthly rent, Korea offers Jeonse (전세)—a unique system where you put down a large deposit (amount varies depending on the area and house value)** and don’t pay rent for two years. At the end of your lease, you get your deposit back in full.

Sounds risky? At first, yes. But if you know how to navigate it, Jeonse can actually be a great way to live in Korea without monthly payments. This guide will break it down in simple terms and help you understand whether it’s the right choice for you.

How Does Jeonse Work?

Think of Jeonse like a giant security deposit that replaces rent.

- Instead of paying a landlord every month, you give them a large sum of money upfront.

- The landlord invests the money (often in real estate or stocks) and makes a profit.

- After two years if you want to leave, the landlord returns your full deposit—assuming everything goes smoothly.

- You don’t pay any monthly rent during your stay.

🔹 Example: Instead of paying $1,500/month in rent for two years ($36,000 total), you might put down a $100,000 Jeonse deposit and get it all back when you move out.

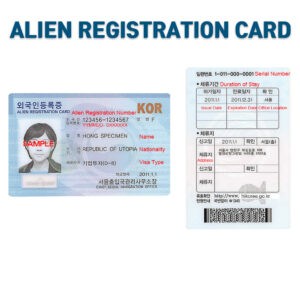

Can Foreigners Use Jeonse?

Yes, but there are some challenges:

✅ Jeonse is legally available to foreigners—you don’t need Korean citizenship.

✅ Some banks offer Jeonse loans to expats (depending on visa status and income).

❌ High deposit amounts make it hard for newcomers who don’t have savings.

❌ Language barriers—contracts are in Korean, and some landlords hesitate to rent to foreigners.

💡 Tip: Work with a bilingual real estate agent and use a bank that specializes in foreigner-friendly loans.

How to Rent a Jeonse Apartment in Korea (Step-by-Step Guide)

1. Figure Out Your Budget

- Typical Jeonse deposits range from 50% ~ 80% of house value.

- If you don’t have enough savings, check if you qualify for a Jeonse loan from Korean banks.

2. Find a Trusted Real Estate Agent (공인중개사)

- Many Jeonse deals aren’t listed online, so local real estate agents are essential.

- Use these real estate platforms to browse listings:

✅Naver 부동산(Naver Real Estate)

✅Zigbang (직방)

✅Dabang (다방)

※They are only available in Korean. You might need to use Chrome’s translation feature, but note that translations may not always be accurate. - Ask expat groups for recommendations on English-speaking agents.

3. Verify the Property & Landlord

- Ask for the Real Estate Registration Certificate (등기부등본) to check if the landlord has mortgage debts.

- If the property has heavy debt, your deposit could be at risk if the landlord can’t repay you.

4. Negotiate and Sign the Contract

- Most contracts require 5-10% of the deposit upfront.

- Your contract should include:

✅ The full deposit amount

✅ The contract length (usually 2 years)

✅ A clear agreement on deposit return - Get a 확정일자 (Registered Lease Date) from the local district(gu) office (구청) to protect your rights.

5. Protect Your Deposit with Jeonse Insurance

- Jeonse deposit fraud is a real issue, but you can protect yourself.

- Enroll in Jeonse deposit insurance (전세보증보험) through HUG (Housing & Urban Guarantee Corporation).

- If the landlord fails to return your deposit, the insurance pays you back.

How Jeonse Compares to Renting in the U.S.

| Feature | Korea (Jeonse) | U.S. (Monthly Rent) |

|---|---|---|

| Payment Type | Large deposit, no rent | Small deposit, monthly rent |

| Financial Risk | Potential loss if landlord defaults | No risk beyond deposit loss |

| Long-Term Cost | Can be cheaper if deposit is returned | Always paying rent with no return |

| Legal Protection | Requires extra steps (e.g., insurance) | Strong tenant rights in most states |

🔹 Bottom Line: If you have enough savings, Jeonse can be cheaper in the long run, but it carries more risk than U.S. rentals.

Why is Jeonse Becoming Less Popular?

Jeonse used to be the go-to rental system, but it’s slowly disappearing because:

❌ Housing prices skyrocketed—making Jeonse deposits unaffordable.

❌ Landlords prefer monthly rent (월세)—since interest rates are low, they make less profit from Jeonse.

❌ Jeonse fraud is increasing—more landlords fail to return deposits, leaving tenants in financial trouble.

💡 Alternative Options:

- 반전세 (Ban-Jeonse): A mix of small deposit + lower monthly rent.

- Monthly Rent (월세): Smaller deposit, traditional rent payments.

- Government-backed Jeonse (공공전세): Lower deposits, but limited availability.

Final Thoughts: Is Jeonse Right for You?

✅ If you have enough savings, Jeonse can be a great way to live rent-free for two years.

❌ If you don’t have a large deposit, you’re better off renting with monthly payments.

💡 Pro Tip: If you’re new to Korea, start with a short-term monthly rental before deciding on Jeonse. This will give you time to understand the market and find a good deal.

Would you try Jeonse, or does monthly rent feel safer? Let us know your thoughts!